Search results

28 results found.

28 results found.

There are numerous credit card categories and signup incentives available. For example, some credit cards offer hefty signup bonuses. Others have top cash rewards. Then there are travel points. Finally, there is balance pay down cards. You just have to know what you need, go over the details, see what you qualify for, and apply for the best card in that category. Because there is so much to cover, this blog post will focus only on one time sign up cash incentives and ongoing cash rewards.

There are basically two ways that credit card companies entice new customers seeking cash rewards as their priority. First, there is a single signup cash back bonus. This is accomplished by offering a set amount of money to be charged on a new credit card within a given amount of time. In addition or instead, there can be ongoing cash rewards.

This particular card is a very good deal all around. It offers a number of excellent credit card signup incentives. In fact, it is ideal for someone seeking a credit card with cash rewards:

• $150 cash reward bonus

• cash back on every purchase, every time

• no annual fee†

• your choice of a 3% cash back category, 2% and 1% categories

Let’s compare the Bank of America VISA Cash Rewards Card with some of my other favorites. In fact, I have several other favorites. Determining which are the best cards or even single card depends on a person’s credit card charging needs or spending profile, as I like to call it. For example, I always aim to get the maximum cash back on every purchase I make. Therefore, when I signup for a card, I like to make sure it fits into my spending profile. For example, these are my major credit card charging categories:

• GROCERIES

• DINING (EATING OUT)

• UTILITIES

• GAS

• HEALTHCARE

• HOME AND PERSONAL PURCHASES

Here is how my system works. For example, the American Express Blue Everyday card offers 3% cash back so that is my card of choice for groceries. It has a similar profile to the Bank of America® card with a few differences.

• $150 or $200 cash reward bonus

• cash back on every purchase, every time

• no annual fee†

• 3% cash back on groceries

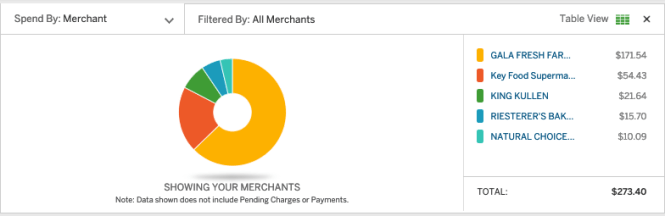

Numerous credit card accounts provide charts like the this one to provide of breakdown of categories of expenses or vendors within a particular category.

This card offers 4% for dining out. It even includes McDonald’s, Burger King, Dunkin Donuts, etc. .

.

The chart below compares values of dining out cards. The Savor Card is close to the highest and charges less than others with higher or similar % bonuses.

This is how I break in a new credit card to receive their one time sign up bonus. If I use it to charge my monthly utility bills such as cable, cell phone, and contents insurance, I charge about $275 a month on it. That easily covers a requirement of $500. in charges in two months. A requirement of $1000 in charges in three months can also be covered with a few extra charges are added in. I have fulfilled the requirements of a number of very useful cards with this method. In addition, I also get monthly cash rewards this way because I use the new card for charges and pay it the following month from my checking account. This technique is a real winner if I can remember which month I am supposed to do what task.

Because Bank of America® Cash Rewards Cards now offers the option of choosing 3% on their new ‘Choose Your Category’ plan, we use it to pay for gas. That is the best cash back rate I have found to date for gas.

The CareCredit® Rewards Master Card pays 2% on health related and other charges that the above and below cards do not cover for more than 1% or 1.5%

*Subject to credit approval.” Quoted from CareCredit® Card’s application material.

TJ Maxx which includes Home Goods, Marshalls and Sierra have special promos that can triple their usual ratio of points for each dollar spent. On the other hand, Home Depot has a $25 signup bonus which is deducted from the first purchase only. There is no cash reward bonus for their card.

As a result of careful planning, almost every charged purchase can earn a cash reward of between 1.5 % TO 5%. One exception is HOME DEPOT. They don’t offer cash rewards. So, from maximum to minimum, this is what a winning hand of credit card cash rewards might look like.

HOME, OFFICE AND PERSONAL: 5% Staples, Target*

DINING AND EAT OUT: includes McDonald’s, Burger King, Dunkin Donuts, etc. 4% Capital One® SAVOR Card

GROCERIES: 3% American Express® Blue Everyday Cash Rewards

GAS: Choose 3% on the new BoA ‘choose your category’ plan

HEALTH-RELATED, PET AND SOME BEAUTY: 2% CareCredit® Rewards MC 2%

EVERYTHING ELSE: 1.5% Capital One® Quicksilver card

*Special offers triple points at certain times of the year

Jim Wang of Wallet Hacks has the best trick I’ve heard of to remember which card offers what. Write it directly on the card. For example, on the Capital One® Savor Card write, ‘DINING 4%’. Just one word to describe the category and the % reward. It works very well when you have three, four, or even five cards in your wallet.

Wallet Hacks

Target

Staples

TJx Credit Cards

Capital One® Savor Card

Capital One® Quicksilver Card

American Express® Blue Cash Everyday Card

Bank of America® Cash Reward Cards

CareCredit® Rewards Card

Credit card cash rewards can offer added benefits to credit card owners. But sometimes it can be confusing to claim them. In addition, not all cash rewards are the same.

There are several types of credit card cash rewards as well as different ways they can be distributed. It is important to know when and how they can be made available to make the most of these rewards.

There are between three and four types of cash rewards. The most direct is the statement credit applied directly to your credit card statement, illustrated above. But which statement is the question. Is it your current statement or your next statement? I often find that a call into the credit card company is needed to clarify this question.

The other types of cash rewards are illustrated here. They are gift cards, merchandise and friend referral rewards.

This is where things can get confusing. Distribution has several options:

• anytime by request online or by phone

• with a minimum of $25 in rewards by the same methods

• in increments of $25 in rewards by the same methods

Option One is the simplest and most direct. Capital One and now Bank of America credit cards both offer this service. See the illustration above,

Option Two is where things can get complicated and there are drawbacks. This is because you can’t withdraw cash rewards at any time. There has to be an accumulation of at least $25 to do so. American Express distributes cash rewards this way. Read the fine print inside the red outline.

Then there is Option Three, the least desirable way to cash in cash rewards. They can only be made in increments of $25. As illustrated below, cash rewards can be distributed only in increments of $25.

Reading the fine print is important to understand what types of credit card cash reward exist and how they can be distributed. You can also learn more about credit cards on this blog by going to the search bar and typing in credit cards.

Capital One Cash Back VISA Credit Cards

Bank of America Cash Back VISA Credit Cards

Wells Fargo Credit Cards

American Express Credit Cards

Compound cash rewards are an important part of Mastering The System of Extreme Credit Card Benefits. To begin with, the largest perks I have gotten are from the credit card sign up promotional bonuses. They start at $100 each with specific qualifications. Once they are met, not only can a customer receive this bonus in a variety of forms but it is also possible to get the regular cash rewards along with it. Here is the reason.

Increments of $20, $25 or even $50 are the minimum distribution levels applied to most credit card cash rewards. Those are the amounts when regular cash rewards are involved. But when someone receives their promotional bonus, the regular cash reward levels are automatically met. As a result, the initial bonus will include both the sign up promotional bonus and the regular cash rewards bonus.

Credit cards require that the purchasing threshold be paid in 90 days to 3 months. I like to complete the process in much less time than that because I often count on receiving these funds to help pay my bills. One way I accumulate purchases while keeping within my budget is to pay all my bills for the month on the new card. Occasionally bills must be paid directly by my bank account. More times than not, I can charge the payment to the credit card I have signed up for to receive a promotional bonus. Between my cable, cell phone, contents insurance, gas, food, prescriptions and even medical bills, I can meet the needed spending threshold within a month. In other words, a card that requires $500 in charges to pay oui a sign up bonus of $100-$150 will net me about 20-30%. Not bad for a month’s work.

One time I signed up for a card without knowing that it did not pay the bonus when the spending threshold was met. When I called the bank to claim my promotional bonus, I was told I had to wait. Their terms are different from any other bank I have gotten a sign up promotional bonus from. Usually I get it immediately. With this bank, I had to wait for the full 90 days. I was not happy about that because it sure put a squeeze on my budget for the month. That was money I had expected to help pay my bills. Fortunately, I would get it next month so it was not a substantial delay. But it was an inconvenience. So be sure to read the fine print or inquire when signing up for a credit card promotion when the bonus is paid out.

For example, one card had a promotional bonus of $150. I met the terms and got my bonus. Almost immediately after that, a new promotional bonus appeared online for $200. As soon as I saw it, I called the credit card company and asked for the additional $50. They gave it to me! You never know what you can get unless you ask. I like to make a habit of asking as often as possible. Being part of The Former Middle Class living rather frugally is an incentive to explore every possibility to get additional perks.

Occasionally someone comes up with a passive, brilliant technique. For example, using something called ‘card linked offers’, Jim Wang of Wallet Hacks has come up with an impressive, passive (nothing to do after it is set up) triple whammie for cashback dining. Read Triple Your Cashback Dining Out at Restaurants for all the details.

Whenever you can, compound your sign up promotional bonuses and cash rewards. With the knowledge of the proper tools and how they can work together, this is possible. Behind every benefit there can be another bonus and even another cash reward. See how many you can collect. In future posts, I will be discussing compounding travel points card benefits and online coupon compounding.

MASTERING THE SYSTEM of Extreme Credit Card Benefits

Using Credit Cards for Survival and Profit

The Poor Middle Class Crisis eBook

The Former Middle Class

Although this final post in the five-part series is about risky cash reward cards and their qualities, I would first like to review the rating system itself. Then this post will get into the details of risky cash reward credit cards and qualities.

To make the most of cash reward credit cards, it is important to know about the qualities of any cash reward credit card before obtaining or using it. This is because not all cash reward credit cards have the same qualities. Therefore, when you know the qualities, you know how to plan for the most benefits from it and how to avoid the least of them. Let me explain how this works by reviewing the traffic signal system I developed.

Cash Reward credit cards can be divided into three quality categories similar to a traffic signal:

GREEN LIGHT credit card cash reward cards are detailed in the blog post Cash Reward Credit Cards Considerations (June 2019).

YELLOW LIGHT cash reward cards are detailed in the blog post, Cash Reward Credit Card Cautions (June 2019).

RED LIGHT cash reward cards and qualities are detailed in this blog post. It is about qualities to avoid or even cards with severe drawbacks. If possible, avoid the card limitations but not the card completely if it has redeeming qualities. As the saying goes, ‘don’t throw the baby out with the bathwater’. Sometimes, I find this does apply to cards that have qualities in the RED LIGHT quality category. Thus, here are some situations where this has proven to be the case.

This post, Part Five of The Credit Card Rating System reveals risky cash reward cards that can present some rather challenging situations. In such cases, I would either pass or proceed with great caution. Anyway, there are several reasons people do acquire such cards:

1. less than stellar credit score which makes better quality cards unavailable

2. lack of knowledge about better quality cards

3. need for any financial benefit at the given time

As mentioned in Part 4, there are many cash rewards credit cards that require caution when using because of the mixed qualities they possess. I also mentioned that in order to manage all types of cards, I had to set up a system for rating cash reward credit cards.

My system helps determine what degree of cautious awareness is required to use such a card and/or qualities safely. Along these lines, I have reserved this post about risky cash reward cards to focus on what card(s) comprise the riskiest qualities to use. In other words, this post is about the ‘Red Light’ Cash Reward Credit Cards qualities and cards that possess them. These can be the least desirable cards to have.

The following information is based upon my own experience and is not necessarily documented research facts. Where it is a fact, a source will be sited.

For instance, the new CareCredit® Rewards MasterCard has some unusual perks. There are categories in which one can receive 2% cash back. They include medical practitioner charges, drug store charges, and some other unique categories for this rate. But there is a serious limitation in cash reward delivery.

This illustration of a long delay to receive a cash reward is a story about The Care Credit Rewards Card. Promotional signup bonus availability does take the amount of time clearly stated in the application, after 90 days.

On the other hand, cash rewards for the most desirable credit cards take simply a matter of days. Here’s where you can get stopped by a red light. It is also where you may have to weigh whether or not the positive considerations outweigh the qualities to avoid.

Read the CARECREDIT® REWARDS™ MASTERCARD®REWARDS PROGRAM TERMS (“Terms”) to learn just what this means. If you can’t find the answer, call the phone number provided. Are you getting frustrated, yet? If not, you will be.

When you call, you have to:

1. be specific about asking for the redemption of your cash rewards, in increments of $10

2. verify your information with the customer service representative

3. clearly state, ‘I want to redeem my cash rewards, now’

4. find out when you can expect your cash reward

5. write down every detail each time a call is placed to them about this

The immediate result is the following. It takes one to two billing cycles after calling to request your cash rewards. The number of months delay depends upon what date in relation to the statement date the request is made. Now, are you totally confused as well? I was.

In some cases, I have spent the minimum needed to qualify for a promotional bonus in less than the time provided. Some cards will pay me the bonus early. On the other hand, some won’t. It is clear which is preferable. Find out the quality related to this. It is important to know how long the wait is.

There have been times when I really needed a promotional bonus to help pay some bills even if it was only $100. It is not always possible to get the best card with double that rate. Therefore, compromise comes into the picture. Because it’s been quite a while since I needed to signup for one of these cards, I am not sure which they are. But you will find out when you see their offer.

In some cases, I have spent the minimum needed to qualify for a promotional bonus in less than the time provided. Some cards will pay me the bonus early. On the other hand, some won’t. It is clear which is preferable. Find out the quality related to this. It is important to know how long the wait is. As mentioned, CareCard Rewards MC is such a card.

Barclay Bank MasterCard®. There are so many other cards that offer cashback so much quicker. One really needs to question why to bother with this one. Unless this card is used to charge all one’s expenses, it does not make sense to use it. In addition, 1.5% is not such an attractive rate anyway. In my opinion, this is one of those cards to sign up for when you just really need the $100. promotional signup bonuses.

There are so many cash reward cards with enticing deals that there should be no reason to acquire a card that offers no cashback or only 1% back. Unless there is a good reason, stick to this. Here’s one exception.

When we went to The Home Depot to make some purchases. We got a $25 promotional signup bonus. That paid for what we bought. But after that, the card has sat gathering dust. We have to make a purchase on it or our credit limit will go up at the beginning of next month. At least they wrote to let us know. On the plus side, there are some good promotions on large purchases and time to pay them off.

Some Chase Cards have very high annual fees. But keep in mind that if you can afford it, the benefits can be commensurate with such a fee. But if money for such a fee is not saved and readily available, it can be a disaster.

As you can see, there are not always very clear distinctions when it comes to choosing a cash rewards card. Some things may work in your favor while some may not. In addition, ratings and credit card consideration details can change over time. It is best to check the most recent information posted about each credit card. Don’t be afraid to ask questions. Keep asking questions until you get the right answer. Reread this blog post series as well.

Here are the links to this five-part series about my Credit Card Rating System:

Introduction to A Credit Card Rating System

The Rating System Used for Cash Back Credit Cards (Series Part 2 – June 2019)

Excellent Cash Reward Cards (Part 3 – June 2019)

Mixed Cash Reward Credit Card Benefits (Part 4 – June 2019)

Risky Cash Reward Credit Cards (Part 5-June 2019)

Please note: I am not a certified financial planner or professional advisor. These blog posts about the use of credit cards are based on my own experience which I freely share. But I can take no legal or financial responsibility for the results you may have in attempting to follow my system. But I do wish you the best and welcome your questions on the comments at the very end of this post.

Compare Cards: Best Cards for Cash Back

Nerd Wallet | Credit Cards Market Place

How Cash Back Credit Cards Work

Mixed cash rewards are the category of cards that most cash reward cards fit into. Therefore, this blog post will offer much details about this category. Unlike Green Go cards that have excellent ratings, these mixed benefit cards can have many pros and cons. Because of this, I refer to them as yellow light cards. Their mix of offerings can make it very difficult to decide whether to go or to stop from securing one.

In order to make the most of mixed cash reward credit cards, one should first compile a list of the pros and cons of the cards being considered. I recommend applying for only one card at a time. Let me explain how the mixed category works.

As described in previous posts in this series, Cash Reward credit cards can be divided into three types of benefit categories. This is similar to how a traffic signal directs vehicular activity. Both the GREENLIGHT and REDLIGHT signal are fairly straight forward in their comment. The former directs one to GO while the latter clear indicates STOP.

But the middle or mixed category does neither clearly. In fact, it leaves the decision up to the driver. That person must make a judgment call on their own. In spite of this, a judgment call does not have to be made blindly.

• GREEN LIGHT credit card cash reward cards detailed in the blog post Excellent Cash Reward Credit Cards (June 2019)

• YELLOW LIGHT cash reward cards and qualities are detailed in this blog post, Mixed Cash Reward Credit Card Benefits (June 2019)

• RED LIGHT means to seriously consider avoiding a particular cash reward card with overwhelming drawbacks.

So far, all the credit cards mentioned in this series have no annual fees. But cards that do have annual fees can pay substantially more rewards, like the Blue Cash Preferred Card from American Express®. For the privilege of the much higher cash reward levels, there is an annual fee of $95. Coincidently, there is also a signup bonus of $250. Right there, the annual fee is offset. For the most part, I prefer not to get cards with annual fees. Somehow, money needs to be made available to pay the fee each year.

This works well for people with savings. But it may not be practical for Former Middle-Class people who barely make ends meet on a monthly basis to allow for this. Saving up $95 for the annual fee tends to be a luxury reserved for the Middle Class. But, in spite of my limited funds, I made a judgment call and went for a card with an annual fee. My thinking was as follows.

Normally, I get 3% cashback for groceries. Figuring charges of around $400/month for groceries at 3% gives me a return of $12/month. That becomes $24/month at 6%. Over a year, I make an additional expense reduction of $120. That pays for the annual fee of $95. In addition, the promotional signup bonus is $250. This is clearly a win-win situation. I just have to make sure I have the annual fee put aside each year. Another point in its favor is that the total of necessary charges. It is $1000 in 3 months. That is the same as many other cards with fewer benefits.

Also, check the fit as described in the third post poker analogy. Does it fit into the % flush or straight flush? Does it have the most benefits for type category you want a card in? Refer back to Blog Post 3as a helpful example. Also refer to the example below.

If you are looking to form an ongoing credit card charging relationship with a home improvement superstore, controversy reign on which store and credit card are best. Lowe’s seems to outrank The Home Depot. Also see the review of the Barclaycard in the Sources & Resources Section at the end of this post.

[caption id="attachment_19475" align="alignleft" width="703"] At first glance, a great deal. But read the fine print.

At first glance, a great deal. But read the fine print.

Green Go cards are clearly transparent in what makes them excellent considerations for cash reward cards. Yellow mixed consideration cards are not as straight forward. Then, the pros and cons need to be weighed more carefully to decide if one in this category is a good choice. Consider the amount of a promotional bonus they pay. Know the % of return and any limitations regarding that. See which side of the scale they tip to, more pros or more cons.

Check the fine print. That means the not obvious, hidden qualities of the card. As a matter of fact, these can result in more negative than positive qualities. For example, the Barclaycard account sounds good at first glance. But it does have one major drawback. I know of no other card with this drawback. Surprisingly it does not pay cash rewards until $50 worth has been accumulated. So beware of such fine print. In addition, Some other cards charge no annual fee for the first year but do charge one after that.

The final post in this series will focus on the qualities and kinds of cards that are in the RED signal area. They should be avoided or pursued with the utmost caution. Because they are risky, sometimes that makes them plain unsuitable in my opinion. In addition, the risk is like making a right turn on red when you’re not sure there was a sign indicating that it is okay to do so. Or you make the turn without looking so see if a card is coming from your left. Beware Risky Cash Reward Cards

Here are the links to this five-part series about my Credit Card Rating System:

Introduction to A Credit Card Rating System

The Rating System Used for Cash Back Credit Cards (Series Part 2 – June 2019)

Excellent Cash Reward Cards (Part 3 – June 2019)

Mixed Cash Reward Credit Card Benefits (Part 4 – June 2019)

Risky Cash Reward Credit Cards (Part 5-June 2019)

Please note: I am not a certified financial planner or professional advisor. These blog posts about the use of credit cards are based on my own experience which I freely share. But I can take no legal or financial responsibility for the results you may have in attempting to follow my system. But I do wish you the best and welcome your comments and questions at the VERY end of this post. You will have reached the end because you can not scroll down any further. As well, you will have reached the comment form.

Compare Cards: Best Cards for Cash Back

Nerd Wallet | Credit Cards Market Place

How Cash Back Credit Cards Work

Credit Cards for Home Improvement

This post, excellent cash reward cards is the third in this series. By now readers most likely understand that in order to choose excellent cash reward cards including the excellent benefits they offer, it is key to have a reliable cash reward credit card rating system. Then one can best evaluate the quality of any card being considered.

As a rule, cash reward credit cards offer all kinds of cash benefits as compensation for making purchases with them. In order to make the most of cash reward credit card choices, you need to know a card’s pros and cons.

As a matter of fact, excellent cash reward cards tend not to have much of anything in the way of drawbacks. In other words, you want to pick a card that bats as close to 1000 as possible. That is the purpose of an excellent cash rewards card.

With this in mind, once you know what to look for and what to avoid, then you’ll have the tools necessary to plan for the best card with the most benefits. In other words, an excellent rated card. Let’s look at this more closely.

Greenlight cash reward credit cards offer these types of benefits:

1. good to excellent percentages on cash rewards (3-5%)

2. $150-$200 promotional bonus for opening an account and even more on cards with annual fees

3. cash rewards are available in any amount at any time

4. rewards redemption is possible by a variety of methods

5. choose from several categories for top rewards rate

6. payment date and statement closing dates can be changes

The benefits include:

a. $200 promotional signup bonus

b. 3% reward in a specific categories

c. user can choose which category gets 3% from several options

d. cash rewards accumulated are available in any amount at any time

e. no annual fee

The benefits include:

a. $150 promotional signup bonus

b. 1.5% everywhere, on everything

c. redeem any amount of rewards at any time

d. no annual fee ever

There’s more to come. Here are the links to all five posts in this series about my Credit Card Rating System:

Introduction to A Credit Card Rating System

The Rating System Used for Cash Back Credit Cards (Series Part 2 – June 2019)

Excellent Cash Reward Cards (Part 3 – June 2019)

Mixed Cash Reward Credit Card Benefits (Part 4 – June 2019)

Risky Cash Reward Credit Cards (Part 5-June 2019)

Please note: I am not a certified financial planner or professional advisor. These blog posts about the use of credit cards are based on my own experience which I freely share. But I can take no legal or financial responsibility for the results you may have in attempting to follow my system. But I do wish you the best and welcome your comments and questions at the VERY end of this post. You will have reached the end because you can not scroll down any further. As well, you will have reached the comment form.

I’ve talked a lot about using cash reward credit cards, lately. It actually feels like I am living in a credit card world. In fact, this for two reasons. One is because I have wanted to learn everything I could about cash reward credit cards, credit scores and credit reports, too. The other reason, probably the most important one, is that cash reward credit cards have become one of my most essential survival tools.

As a result of my intense interest and need to know everything I can about credit cards, I’ve even created a Facebook page called The Credit Card Maven. This is where I post information as I have researched and sourced it. I have found a number of websites, blog posts, Facebook pages (listed here) and groups that are extremely helpful resources in my quest for knowledge as The Credit Card Maven in my credit card world. Included are:

• Credit Card Mastery

• Credit Karma

• CreditCards.com

• NerdWallet

• Wallet Hacks

• Wise Bread

As I mentioned at the start of this post, credit cards have become a survival tool in my credit cards world. It was not by design that this came to be.

It was more a matter of circumstances. Once I got a feel for how useful and profitable using credit cards could be, my desire to use them and master it increased. Let me give you an example.

I have had cash reward credit cards for a number of years. I can accumulate up to about $40. in a two month period from one of them. That was a good beginning. Then I decided to get a travel rewards card in anticipation of someday going to visit my family in Colorado. I used it and kept on accumulating points.

When I went to check on the conversion to paying for an airplane ticket, the results were not impressive. I had to find something better. This time by design, I set out to find the best deal I could for air travel benefits using a credit card. I found one that I ultimately used for my flight. It rewarded me with 30,000 points and a $100. discount on my airplane ticket. This was such a great deal that I have enough points to return to Colorado for free, right now.

Let me present one more situation where the skilled use of a credit card became very profitable. I found an offer for a cash rewards credit card that would refund $100 on spending $500 within 90 days of acquiring the card. That would be a 20% profit. I had never accomplished that in the stock market. It seemed like a very good investment to me. I wasn’t sure if I would be granted another card as I had accumulated quite a few by this point. But it came through. I fulfilled the requirements. Now I am just waiting for my investment to pay off.

I made another discovery. It may seem a bit confusing. In fact, I am kind of surprised that I am even able to do this. I am calling it credit card monthly rotation. It is based upon a combination of the nature of credit cards themselves and good credit card hygiene.

Each credit card has a closing date and a payment due date. Since I have several cash reward credit cards and they have different closing and payment dates, I can stagger them and not have to pay them at the same time. If I make my purchases and schedule my payments using my monthly rotation system, I have a revolving credit situation. In other words, if my budget in a particular month needs to be exceeded, I can use a card that has a closing date that will allow payment the following month. I just have to make sure the funds will be available then. I also have to have a very good bookkeeping system to keep track of every detail of every card.

What is credit card mastery? Have I achieved it? It turns out that this term exists. I did not invent it as I thought I had. There is actually a course called Credit Card Mastery that costs $97. Much of it seems similar to my own system. Although I have not taken that course, it looks very comprehensive. This is an introduction to the course and an explanation of it by founder, Brian Cain.

Based upon my understanding and goals to achieve Credit Card Mastery, I believe that I am on my way but I have not achieved mastery yet. When will I achieve it? There are several requirements that I have established for myself:

• My credit scores average will be over 800 again. It is only about 10-20 points from that now.

• My monthly rotation system will have proven itself to work and I will have a sense of mastery in my credit card world

• My Credit Card Management Chart will be complete and committed to memory. As a result, I will have a firm grasp on all my cards and a natural flow for their use in rotation as needed.

To many people, understanding credit scores and reading credit reports are overwhelming and confusing. There is no need to not have transparency and clarity about your credit cards world. Credit cards are an important tool and can even be crucial for personal survival and business development. Study the resources provided. Take the Credit Card Mastery Course if you can. Having one’s finances in order and being able to live solvently in a credit card world are not luxuries. They are necessities and everyone deserves to have them.

CreditCardMastery.com, a course developed by Brian Cain

CreditCards.com, find a credit card that’s right for you

CreditKarma.com, free credit scores and more

NerdWallet.com, Best Credit Cards of 2017

NextAdvisor.com, all about finances

WalletHacks.com, founded by Jim Wang

WiseBread.com, great blog post advice about credit cards and everyday frugal living

FICO SCORE AND CREDIT REPORTING AGENCIES

Equifax

Experian

Transunion

Identity Guard

‘Stop and Proceed Slowly’ Sign by ComplianceSigns.com

‘Stop and Proceed Slowly’ Sign by ComplianceSigns.com

I have written at length about the potential benefits from the responsible use of credit cards. Below are the four Ebook I have written about various credit card benefit offers. These minimally priced Ebooks are available on Amazon.

Without blinking, I went from qualifying for one, then four, and even as many as six of these credit cards. Even then, I kept finding more of these offers. Since I did not want to miss out on a single one of them, I kept applying and being accepted.

Wells Fargo Promotional Bonus Credit Card Offer

Wells Fargo Promotional Bonus Credit Card Offer

Because I couldn’t stop, things really got out of hand. With each new card, the game I was playing became increasingly complicated as well as much less manageable. It became harder to keep track of all the rules. I kept making charts of when and how charged were due. Even with this extra effort, I still went from feeling high to feeling totally overwhelmed.

But there is one catch to building an emergency fund with this program. Money has to go out before it can come in. For a while it has seemed that I have lost rather than gained financially.

This is a very tricky game requiring numerous greater than rudimentary skills. It feels like the Olympic decathlon competition. In fact, I am now having to use the partial-pay 0% APR feature that comes with these cards. Therefore I am learning something else that is new. But I have been pulled deeper into this maze. I never paid attention to APR percentages in the past, nor did I need to. But now, how many months will I need to use this new tool keeping to the 0%APR?

Sometimes, the way I learn things is by going to extremes. It involves extending the limits of my existing skills to see what new ones I want to gain. Taking little steps would be more prudent. In fact, I suggest taking small, prudent steps for anyone who wants to sign on to this or any cash bonus program.

Were you able to navigate this obstacle course? I’d love to hear your experience. Please share with the rest of us in the comments area. I will report in with my final results as soon as I am done. Right now, I’ve got two cards to go. One is to make a claim. The other is to charge $500 and then make my claim.

21st Century coupon cutting is a transformation of the previous century system. In fact, the new system is digital coupons. Therefore, going forward in this series, look more and more for keywords that refer to digital coupons rather than coupon cutting. But don’t throw your scissors or coupon organizer quite yet. Instead, prepare to use them less and less. Happy savings, 21st-century style!

This is a sample of what the comment area looks like. It is active at the bottom of this page.

How many are too many? Is there a set rule or a prescribed limit? Apparently not from what I have read. But what I have found is that when I have to spend hours almost daily to monitor them, it is too many for me.

When I discovered that cash reward credit cards could be a reliable way to reduce my monthly expenses, I started applying for them as often as I could. Of course, the idea was to get the largest promotional welcome bonus, the highest % of cash rewards as well as a substantial amount of available credit. Therefore for about the last three years, gathering cash reward credit cards has become a major pastime. Well, guess what? Now I have too many cards.

It has been a tremendously educational experience collecting all the cards I have. Primarily, it has helped and still helps to reduce my expenses. In addition, I have written many blog posts and several Ebooks about this. Doubtless, there will be more. But the most significant comment I can make at this time is that right now I have too many. As I mentioned in a previous blog post, I have reached critical mass.

For most of this time, my primary concern has been focusing on the 5 or 6 FICO® credit score factors that go into building a good credit score. Certain cards have taken priority for charging purchases. Then it recently occurred to me that if I did not start using all of my cards, some could be closed for inactivity. That could affect my credit score negatively by lowering my available credit, changing the average length of time I have had cards and flagging too many closures. Low and behold, that is exactly what happened this week. One of my co-branded cards was closed without notice for inactivity.

I need enough cards to satisfy the FICO® score factors. Fortunately, I found a formula that I could use to determine how many cards to own, which ones to keep and those to phase out since I had surpassed critical mass. These are the factors I now consider in which cards to use:

a. the oldest aged accounts

b. those with the best credit line and lowest credit utilization ratio

c. the ones with optimal returns in my top spending categories

d. those that give me the maximum value for use with my favorite merchants, stores, airlines or hotels

My sense is that I would like to have no more than ten at the most. For example, my ‘straight flush’ analogy illustrates most of them. Beyond that, I think that one or two travel cards are essential. Other than that, an additional card or two in the ‘straight flush’ formula would be OK too.

I am at a new beginning. I have climbed the credit card mountain in excellent standing. Now it is time to descend the other side with equal care. Therefore future writings on this topic will involve reducing my load doing my best to maintain my great credit card standing while keeping also 6 FICO® score factors in balance.

How Many Credit Cards Is Too Many?

How Many Credit Cards Should I Have?

Images of Many credit Cards