Introduction

My goal, as a retiree on a very fixed income as well as a member of The Former Middle Class is to make ends meet on a monthly basis. I find that Using Credit Cards for Survival and Profit is very helpful to accomplish that. But in order to do this, a credit card accounts maintenance system is necessary. Because I have used my system religiously, I have graduated to Mastering The System of Extreme Credit Card Benefits. The purpose of this post is to describe my system in detail so that you might be able to take these steps to make ends meet, too.

Because my credit card accounts maintenance system is so effective, I can manage a substantial number of credit cards responsibly and profitably. Even as the number of credit cards has increased, it has not interfered with my accounts staying in order. In addition, my credit scores continue to hover between 780 and 800, my credit report profiles are in good standing and I have very good to excellent credit.

My Credit Card Accounts Maintenance System

I’ve developed a Credit Card Accounts Maintenance System that consists of a set of tools combining old fashioned manual bookkeeping techniques with up-to-date digital tools:

1. credit card information chart

2. manual ledger paper spreadsheet

3. digital bookkeeping program with checking ability

4. manual checking account with a colorful checkbook cover, checks and paper register

5. email access to and from all my accounts

6. online account access to each credit card listed in my bookmarks

7. online bill paying capability

8. telephone contact with each credit card company

1. Credit Card Information Chart

I created a table in Microsoft Word®. It consists of the data for all my credit cards. That includes every bit of pertinent information about each card. There are even icon size images of all my credit card for visual recognition and order. See the categories shown below this illustration.

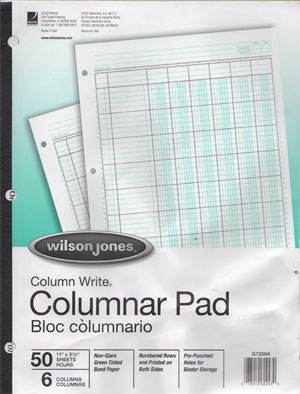

2. A Manual Spreadsheet

Perhaps because I grew up in the paper world before the computer, I still find it easier to use manual ledger paper for my credit card accounts maintenance system. But if I become more comfortable with Excel, I might shift my spreadsheet to Microsoft Excel®. Digital or manual, it is possible and prudent for me to keep a tally of every dollar I have charged on each card. Actually, all my tools create a checks and balances system to make sure my accounts are accurate. It doesn’t matter if they are manual or digital. Use what works for you.

3. A Digital Bookkeeping Program

Because I have a Macintosh Computer, I got the only bookkeeping program that was specific to Apple many years ago. It was originally called, MYOB an acronym for ‘Mind Your Own Business’. The name was updated to Accountedge because it now has many accounting features in addition to its original bookkeeping features. Accountedge.

4. Manual checking account with a checkbook cover, checks and paper register

I still pay a few bills manually using checks. Doing this makes it possible for me to keep track of certain personal loans as I pay off them off. This way I have a check copy on my monthly statement for record keeping and documentation. The purpose of my Checkbook Register is to keep a record of every financial transaction I make. I even devised a system of color coded symbols that shows when:

a. a purchase was made

b. it is recorded online by my bank

c. I entered it into my online bookkeeping system

5. Email access to and from all my credit card accounts

The Credit card companies contact me by email. They remind me when bills are due and let me know if there is some other issue concerning my account.

6. Online Account Access to Each Credit Card

I bookmark every credit card URL so that I can easily check each credit card account daily. This is another way for me to make sure that the numbers online coincide with my manual spreadsheet numbers.

7. Internet bill paying capability

Each credit card websites is listed on my Internet bookmarks to be accessed easily. Most of my bills are paid on line. Some are even on autopay. When I get a new card, I have my closing and bill paying dates adjusted so that my payment is due shortly after my monthly fixed income arrives. This way I can get all of my bills paid on time and not have to think about whether or not I paid them all month long.

8. Telephone Contact With Each Credit Card Company

Having telephone contact is very important. One can use any phone, a landline or cell phone. I make telephone contact with each credit card company when I have questions about my balance, closing or due dates.

Since most of these companies are open 24/7, I enjoy calling very early in the morning. It is usually the quietest time at their end. I’ve enjoyed hours of what become personal interest conversations with their staff who are located around the globe. It is fascinating and one of my favorite tools. In fact one call was such a delight for both of us that the customer service person from Capital One actually sent me flowers!

Conclusion

As I mentioned in the previous post, if a person needs or desires to have many credit cards, it is prudent to keep a very close watch on them in order to maintain a good relationship with each company as well as the credit reporting bureaus. This involves accurate reporting to keep my credit score high, to pay all my bills on time and stay within my budget. Because having many cards is based on need, I am very careful about using them responsibly. It is essential for me to be able to I continue to make use of what has helped me to make ends meet since we became part of The Former Middle Class. Extreme credit card benefits have been a tremendous help to me in making ends meet.

Sources and Resources

Wilson Jones Ledger Sheets Pad

Accountedge Accounting and Bookkeeping Program

Checks and register from checkworks, inc.

Word Tables

Excel Spreadsheets

1-800-Flowers

Telephone from lifehack.org

Capital One

Credit Reports