How I Became A Survey Junkie®

You may wonder, ‘how does one become a survey junkie’? How I became a ‘survey junkie’ is something I ask myself from time to time. Let me go back to explain how it happened.

The Poor Middle Class Crisis

Back in 2009, when we became One Day from Homeless, our finances and our lives changed completely. We went from being part of the gainfully employed middle class to part of The Poor Middle Class Crisis.

In our new Former Middle-Class Life, our weekly salaries and monthly investment incomes no longer existed. Instead, they were replaced by very limited monthly retirement social security incomes that had to last all month. To say the least, it was not easy. To put it bluntly, we became like feral children without the benefit of parents or teachers. We had to learn how to survive on our own and all over again. We had become part of The Former Middle Class.

Supplemental Survival Tools

What changed the most was our daily routine. Rather than showering and dressing in 9-to-5 Manhattan garb, we set out in old jeans or sweats to collect bottles on recycling days and cashed them in on other days. We also dress casually for the other parts of our routine. We frequent two food pantries once a week and one food pantry once a month. Between these tightly budgeted visits to supermarkets on senior discount days and doctors visits on other days, our weekday schedule is complete.

In between these activities we have our own indoor farm. We grow microgreens and sprouts to supplement our food pantry diet which tends not to have much fresh produce. In the warmer weather, these foods are not only delicious but super packed with nutrients. But here as well, indoor farming is time-consuming and can be hard work.

Once a day we do eat a substantial, home-cooked meal. The other two meals are more like snacks that include pantry scavenged food. I tried growing our own food, microgreens as well as sprouts, in our one bedroom apartment. I even got a food compost system to recycle food scraps into worm digested, super fertilizer. But that became arduous. We needed to discontinue these survival supplements and find easier solutions.

Using Credit Cards for Survival and Profit

As I detail in the second book of The Former Middle Class Ebook Series, I taught myself how to benefit from using credit cards. I developed a system that allowed me to decrease my monthly expenses with sign up promotions and cash rewards. Although soil is not a dirty word, using credit cards for survival and profit is a lot cleaner undertaking.

To this day, using credit cards for survival and profit is our most sophisticated undertaking. But it in itself has become a daily, part-time job. To keep on target financially requires hours each day checking online credit card accounts, going over spreadsheets, recording expenses, and tallying expenses by credit card and category of expense. At times, it is mindboggling. There are days when I even feel like it is ‘Greek to me’. In addition, I have accumulated a substantial number of credit cards that have to be rotated every few months to keep them active and viable.

With all the challenges involved in this system, we have managed to rise to FICO credit scores of over 800! When it was below that, I was able to find out why and quickly remedied the situation. I am very proud of this accomplishment and still apply for additional cards but much less often. This finally brings me to where becoming ‘a survey junkie’ came into the picture.

Other Supplemental Survival Tools

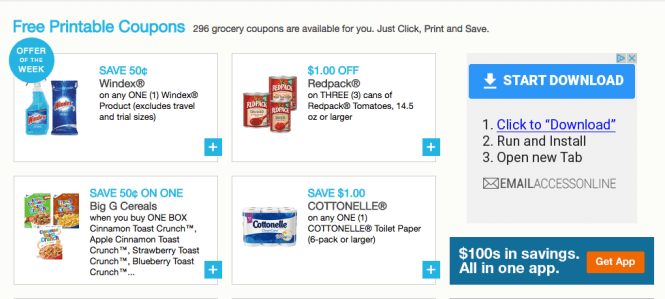

Over time and between discovering this boon to our survival, I needed to explore what I call, other supplemental survival tools. Many of them are explored in Chapters 4 and 5 of the first book of The Former Middle Class Ebook series, The Poor Middle-Class Crisis.

It is not a good idea to apply for new credit cards too often. It can raise a red flag with the credit card provider companies, resulting in denials and lower FICO® scores. In order to avoid that, it is necessary to introduce supplemental survival tools. One of my financial gurus, James Wang of Wallet Hacks, often has terrific suggestions on his blog. Here’s one, Surveys for Money.

Surveys for Money

Way back when we became part of the poor middle-class, we really struggled financially. We had to adjust to a much lower standard of living. Not only that, we had to find perks to survive and still live a somewhat healthy life. Taking surveys was an option that came up in our research. But at that time, I found the idea boring and unappealing.

Well, things change over time and one’s perspective on what is acceptable and or distasteful have to adjust. Therefore surveys started to look interesting. They really didn’t take much time and they could actually be fun. In fact, I began to feel like I was part of the population that helps determine marketing procedures for products. I even felt special. The main thing is to take as little time doing it and make it a game rather than a nuisance.

James Wang has suggestions for technique as well as actual surveys. He puts Survey Junkey® first on his list. It is my preference and the only one I use. That is because there are too many available to make it time effective for me to participate in. It is also because I know it has the James Wang seal of approval. I have found that I can comfortably have a survey bonus of about $10. a month. It is possible to get much more. But my Survey Junkie® addiction is satisfied with by that. Stick around for more supplemental survival tools and other helpful topics.

SOURCES AND RESOURCES

Wallet Hacks® by James WangSurvey Junkie®e®

The Poor Middle Class

One Day from Homeless

Using Credit Cards for Survival and Profit

Why Did My FICO® Score Decrease by 12 Points in One Month

The Former Middle Class Trilogy

Soil Is Not A Dirty Word

Seed Mama Indoor Farming