INTRODUCTION

There are three ebooks in The Former Middle Class Trilogy.The first ebook is called, The Poor Middle Class Crisis and the second ebook is, Using Credit Cards for Survival and Profit. The ebooks are available on Amazon.com. Mastering the Art of Green is my third ebook in the Former Middle Class trilogy.

THE POOR MIDDLE CLASS CRISIS

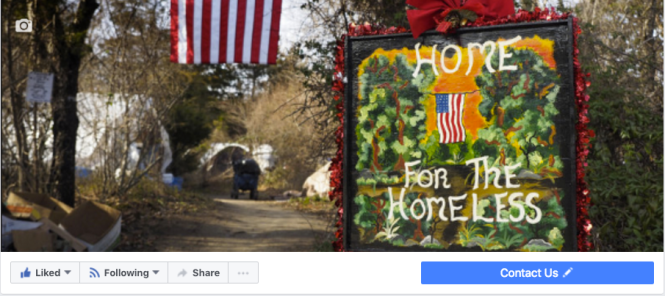

The Former Middle Class.The Poor Middle Class Crisis chronicles our history as people who were devastated by the 2008 stock market crash. My husband lost his job the same week as the crash. He was 62 at the time. I became very ill from all the stress.We had become part of The Former Middle Class and did not know how we were going to survive. Our low point was when we faced the possibility of having no place to live and were, One Day From Homeless.

Our journey became one of survival. That became our priority. We had to learn to live all over again under very different financial circumstances. We explored many different avenues and began to build our financial survival tool kit.

OUR FINANCIAL SURVIVAL TOOL KIT

Building our kit involved many lifestyle changes. We went from a two bedroom apartment to subsidized senior housing. Access to food was a big challenge. Instead of the opportunity to purchase expensive, organic foods and eat out on occasion, we had to depend on the generosity of others and the government. Food pantries and food stamps are crucial financial survival tools. But they may be hard to swallow.We went from middle class comfort to former middle class frugal living. It was a huge adjustment. We explored many tools that didn’t work for us. Things like couponing and taking surveys. Many more thrifty tools are mentioned in the first ebook. Eventually we found one tool that not only helped us survive but also became profitable. That tool is credit cards.

USING CREDIT CARDS FOR SURVIVAL AND PROFIT

Let me make very clear right from the start that our use of credit cards has involved a very responsible set of guidelines. We pay all our bills on time and in full. Our credit rating fluctuates between 775 and 800 depending upon which credit reporting agency you ask.Credit cards have given us a financial cushion between sign up promotional bonuses and monthly cash rewards. My refinement of credit cards as a financial survival tool lasted about eight months. What I have learned, and continue to learn about credit cards is fascinating and extremely informative. I have my accounts charted with spreadsheets for each month. Read My Credit Card Accounts Maintenance System for the details of my system.

In less than a year, I had become sophisticated in the financially lucrative use of the credit card benefits tools. All of a sudden, the additional hefty promotional signup bonus credit card memberships applications began receiving denial letters. My stellar tool of acquiring credit cards with promotional sign up bonuses of $100-$200 had lost its winning streak. Clearly, it was time to rest that tool, re-examine some of the other financial survival tools that I had discarded in the past and to research additional new tools. I was at a loss and needed new financial fertilizer.

MASTERING THE ART OF GREEN

Mastering the art of green is a process. For me, it has involved taking stepping backwards to get a different, larger view on what ‘green’ means. It can refer to money. It can refer to food, lush grassy fields, innocence and inexperience.Sure enough, once I stepped back and started to look at green in a new way, as fertility and productivity, new tools started to sprout. I started growing food indoors calling it, Table Top Farming. I am growing microgreen in soil and hydroponics in water.

This project is of major importance to us since healthy, live food sources can be scarce for seniors on fixed incomes. Food pantries tend to offer the lowest quality packaged/processed food. The SNAP (food stamp) program provides a miniscule amount of money to supplement nutritious food. So growing one’s own live, local greens can be better than money in one’s pocket.

RECONSIDERING COUPONS, STORE SALES AND SELLING SITES

Coupons and other money saving programs do have their value. They are not as lucrative as credit card sign up promotional bonuses. But what is? There again, when I took a step back to get a better perspective on what made sense for me to pursue, I found many options.

Some coupons like the specials CVS Pharmacy and Michaels Stores-Art Supplies, Crafts and Framing offer can be as high as 40-70%. A Bed, Bath and Beyond 20% coupon get help a lot on a $100 plus purchase. Target, Walmart and Amazon vie for top savings. In addition, there are programs that will automatically check to see if there is a savings special when an online purchase is made. These include Ebates, honey, and cently and piggy. Other apps exist that I have not yet had a chance to explore. Two of the most popular are ibotta and Groupon.

Decluttering, Sarah Mueller style can provide lots of potential items you no longer need and want to sell. The above video is from a workshop she did with an expert at selling stuff. Two of the most popular selling sites are Ebay and Etsy. I have not sold on Ebay. I do have an Etsy store, Tin Can Ali. It displays some of my painted items for fun. I have not really tried to sell anything. But Ebay can be a great place to sell things especially if you watch the Kathy Terrill videos from I Love To Be Selling.

CONCLUSION

As you can see, the possibilities are endless. Prioritize your options. Find what is most beneficial and takes the least time to execute it. New savings hacks are invented all the time. Be resourceful. Do the research. Continue to read my and other blog posts for the latest information.SOURCES AND RESOURCES

Wallet Hack’s article Target’s Store Shopping HacksWallet Hack’s Article 10 Sites That Pay You Money for Things You’re Already Doing For Free

Ann Gibson The Micro Gardener

Sarah Mueller Decluttering Club

Kathy Terrill I Love To Be Selling – Kathy Terrill

Alison Gilbert’s Facebook pages and groups:

Table Top Farming

Survival Comes First

Savvy Saving Survivalism