Introduction

In addition to the inequity of money is the fact that many of us no longer have enough income or savings to live the traditional life we grew up with or used to have. In other words, we are no longer Middle Class Americans. We are part of the Poor Middle Class Crisis. Many of us are in debt. Many of us baby boomers are now seniors and beyond significant employability.

The most devastating causes of the loss of one’s money can be a serious illness, a death, the termination of a good job, as well as storms and earthquakes. A significant economic downturn can scoop up more of the Middle Class and deposit us, like yesterday’s trash, into the heap of The Poor Middle Class. Some people ended up in the depths of poverty and homelessness from the horrific hurricanes of 2005 and 2012 and the stock market crash of 2008.

Learn more about The Poor Middle Class Crisis and our story in the Poor Middle Class Crisis eBook available on Amazon.com, the introductory facebook page of the same name and the companion facebook resource, support group, Financial Survival Resources for The Poor Middle Class.

Time For A Change

Here is an introductory video to the homesteading life, Off Grid with Doug and Stacy.It is time for a change, a paradigm shift to a new kind of economy. We need an economy that offers alternatives to money as its foundation. We no longer have a large Middle Class or the ease to be part of it. Our government’s focus has shifted. We have a growing Poor Middle Class and increasingly fewer people in possession of the government produced money.

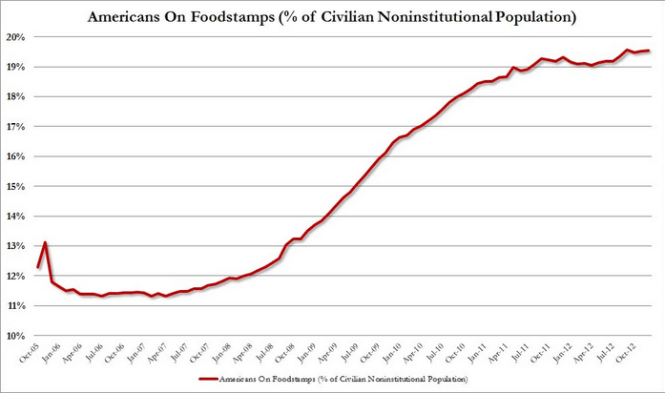

If the economic paradigm does not shift, this is the direction we are headed in. Many people will have to live like slaves. They will continue to have to work two and even three minimum wage jobs. Even then, they may barely make enough money to survive. Also, they may still need government assistance, like food stamps to make ends meet and health insurance to survive.

Disastrous Results From Uneven Distribution of Government Money

If people are not fortunate enough to find work, are not able to work, can’t support themselves or their families and cannot get enough government assistance, they may also become homeless. The number of homeless people in this country is also increasing. One of the changes that needs to take place does not involve going backwards.

The problem will not be solved by increasing jobs in outmoded technologies that will be short lived and not provide health insurance. It will also not be solved by the government’s shifting money around where even less goes to the needy and more goes to national defense. As we know, the haves will rarely give enough to help the have-nots unless they are forced to. It does not look like the current administration is of the mind to force the very wealth to do so. This would require a substantial tax restructuring. This is not going to happen, either. Therefore, what is required is a completely new kind of economy.

Exempt From Disaster

The ultra-wealthy 1% and other very wealthy people might be exempt from needing to be part of this paradigm shift. They could keep their money. In fact, they would continue to monopolize this government commodity. But for those of us who suffer from the lack of money and the results of the unwillingness of the wealthy to share theirs with us, we need a system for The Middle Class, The Poor Middle Class and The Poor to rely as little as possible on government controlled money. As the saying goes, ‘the solution is not in the problem’.

Alternatives To A National Government Money Based Economy

I believe that we are in the beginning of this paradigm shift. Money is becoming harder to come by for too many of us. Therefore, we need to be less dependent on it. As a matter of fact, cash produced by our government is much less involved in our daily goods and services transactions. Here are some of the ways this has already changed:

• Community currency or local currency is defined by Wikipedia as “In economics, a local currency is a currency that can be spent in a particular geographical locality at participating organisations”.

• Bartering all kinds of food and products (on an individual or community cooperative basis) The Barter Network

• Acquisition without money such as foraging for food, using natural sources of energy, street find, reuse of existing found materials, scavenging for food and other usable items

• Homesteading and off grid living as close to what nature can provide with a bare minimum of cash to live such as Off Grid with Doug and Stacy

• Bitcoin is a digital, international coin system not produced by the US government

Conclusion

This is just the beginning of opening the doors and windows of the proverbial ‘thinking outside the box’. Paradigm shifts do not take place overnight. They only appear to in an historical perspective. We do not have that perspective, yet. This movement is much too new. But the good news for many of us is that is it a is happening and it is in its beginning.

Sources & Resources

The Viper Tool Storage Company

The Poor Middle Class Crisis eBook